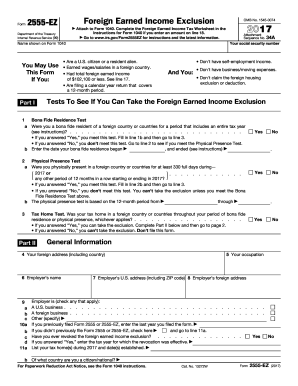

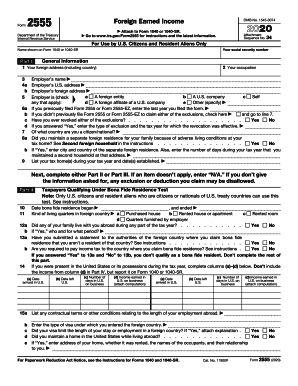

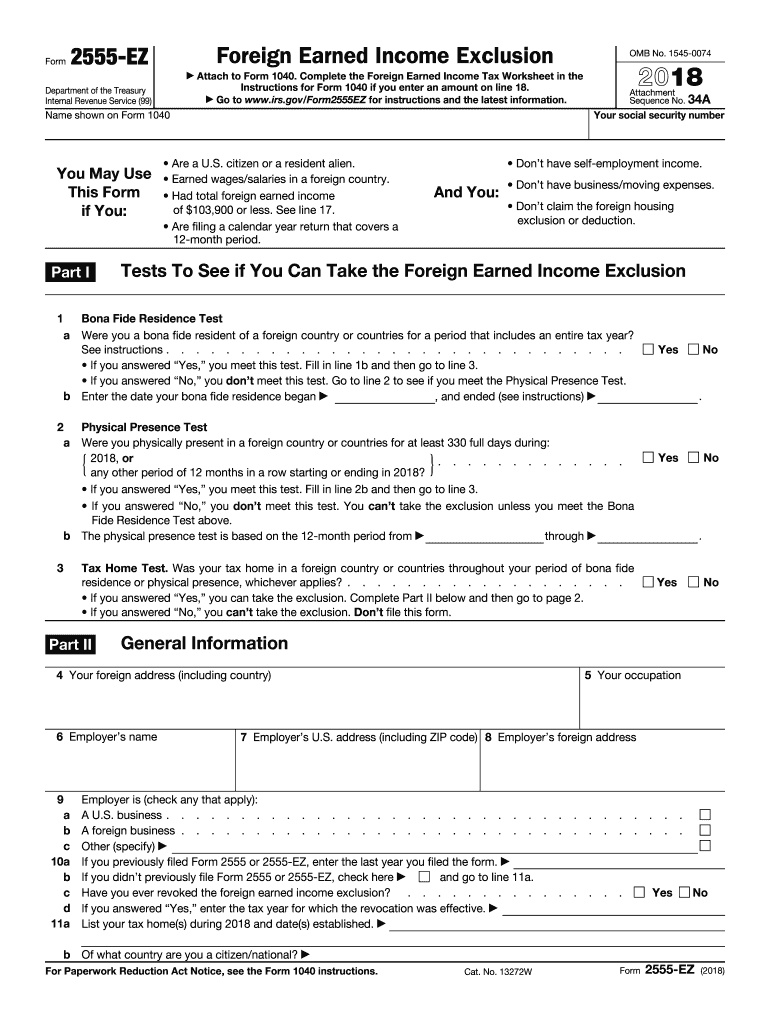

IRS 2555-EZ 2018-2026 free printable template

Instructions and Help about IRS 2555-EZ

How to edit IRS 2555-EZ

How to fill out IRS 2555-EZ

Latest updates to IRS 2555-EZ

All You Need to Know About IRS 2555-EZ

What is IRS 2555-EZ?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Is the form accompanied by other forms?

FAQ about IRS 2555-EZ

What should I do if I realize I made a mistake after filing IRS 2555-EZ?

If you've already filed your IRS 2555-EZ and discover an error, you should prepare to amend the form. You can create a corrected version and submit it as an amended return. Ensure that you clearly mark it as amended, and it’s wise to include an explanation of the changes. Keeping records of all forms submitted will help in the event of any follow-up.

How can I track the status of my IRS 2555-EZ submission?

To verify the receipt and processing of your IRS 2555-EZ, you can use the IRS's e-file tracking tools. If you submitted electronically, check the confirmation email for acknowledgment. Common issues include rejection codes, which you can typically rectify and re-submit without penalties if addressed promptly.

What privacy measures are in place for the information I provide in IRS 2555-EZ?

The IRS implements robust data security protocols to protect personal information provided in forms like IRS 2555-EZ. Record retention guidance suggests keeping copies for a specific period. Always ensure your submissions comply with privacy standards to safeguard your information.

Are there any common errors to watch out for when submitting IRS 2555-EZ?

Yes, common errors include incorrect personal details, mismatched income amounts, and missing signatures. Double-checking all entries before submission can help avoid these mistakes. It's advisable to consult certain guidelines to clarify complexities and ensure accuracy.

What should I do if I receive a notice from the IRS after filing IRS 2555-EZ?

Receiving a notice from the IRS after filing your IRS 2555-EZ warrants immediate attention. Review the notice carefully, gather necessary documents, and respond within the stipulated timeframe. You may need to provide documentation to support your filings; consulting a tax professional can be beneficial.